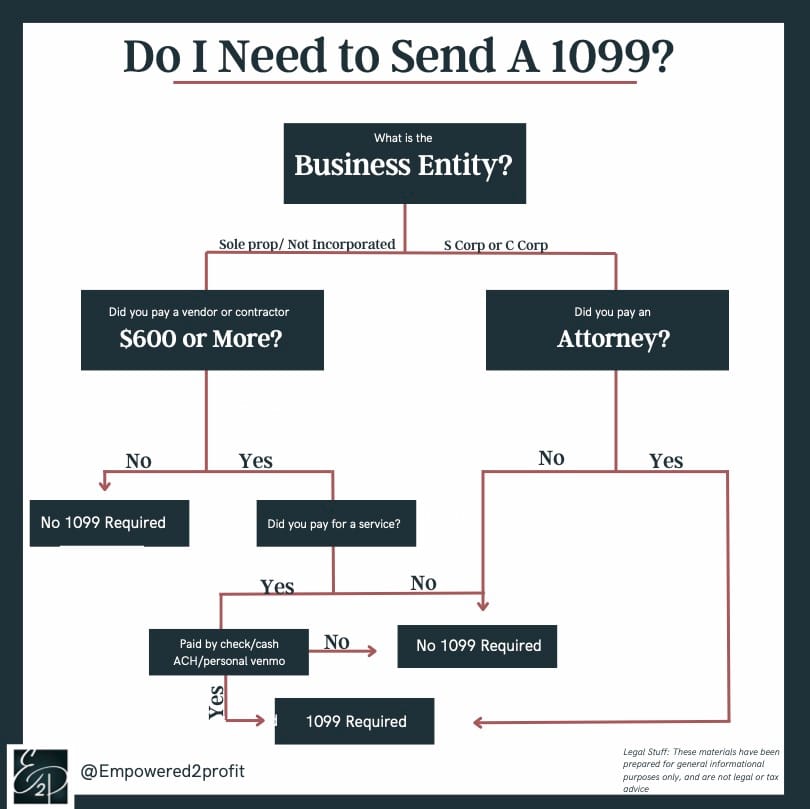

We are gearing up for the 1099 season, if you are new to this- it’s the IRS requirement to send a tax form to certain service providers paid by cash, check, ACH, or wire transfer. A copy of the 1099 also goes to the IRS, so it’s important that it be accurate.

Submitting a 1099 takes:

- Accurate records (how much did you pay this service provider)

- Key personal information from your service providers

That’s why we start prepping in Octover – to give you plenty of time to track down or request what’s needed to file this form. Here’s the deal: You need accurate books to know if you’ve paid any service provider more than $600. If they haven’t filled out the required forms yet, have them do it ASAP – it only takes 2 minutes.

Now in January when it comes time to file, you can use a software like Tax1099 – it makes it simple! Or our team can do it for you.

Remember: if a 1099 is owed, it is due by January 31. Who gets a 1099? This chart should help:

Do not let this season stress you out, Januray is busy! START prepping NOW!

Make sure your books are accurate (so you know who you have to issue a form for)

Obtain a W9 for all service providers who meet the requirements noted above. File your 1099s!

If you haven’t started your 1099 process, do it now! If you need help navigating – set up a call with us or just have us do it!